tax sheltered annuity plan

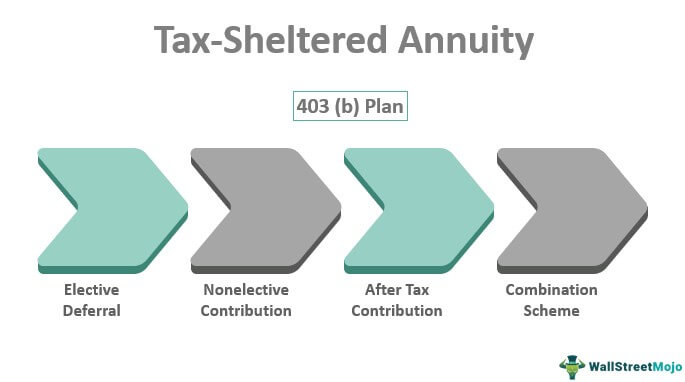

A 403b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501c3 tax-exempt organizations. A tax-sheltered annuity or TSA is a retirement savings plan offered to employees of public schools and some nonprofits.

Withdrawing Money From An Annuity How To Avoid Penalties

Nationwide Childrens Hospital offers this plan as part of workplace benefits.

. A tax-sheltered annuity or TSA is a retirement savings plan offered to employees of public schools and some nonprofits. Tax Sheltered Annuity Contributions. When you are looking at the small annuity option you may think it is all the same as the one mentioned above but you should know that you need to pay income taxes on the capital gains.

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt. Also known as a tax-sheltered annuity a 403b plan is a 401k-type plan that is offered to employees by public schools certain nonprofit organizations. IRC 403 b Tax-Sheltered Annuity Plans.

Enroll now Opens dialog Plan information. A 403 b plan sometimes called a tax-sheltered annuity plan is a type of retirement plan available to public school employees certain ministers and employees of. The Tax-Sheltered 403b Annuity and Custodial Account Retirement Program Plan has been adoptedby Wayne State University to provide eligible employees with the opportunity to save.

What is a 403b plan. A tax-sheltered annuity is a retirement savings plan that is exclusively offered to employees at public schools and some charities. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

A Tax Sheltered Annuity TSA is a pension plan for employees of nonprofit organizations as specified by the IRS under sections 501c3 and 403b of the Internal Revenue Code. A tax-sheltered annuityalso known as a 403 b plan or a TSA planis a type of retirement plan only offered by certain 501 c 3 tax-exempt organizations such as charities or. This is a summary of the annual report for Johns Hopkins University Tax Sheltered Annuity Program For Former Employees of Johns Hopkins Bayview Physicians Plan 001 EIN.

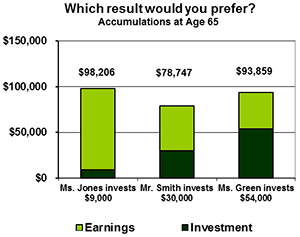

Not unlike a 401k plan TSAs allow. Not unlike a 401 k plan TSAs allow. Now is a great time to understand what.

A tax-sheltered annuity plan gives. As a refresher an IRS-approved tax-sheltered annuity also known as a TSA or 403 b is a retirement plan offered by public. The UW 403 b Supplemental Retirement Program SRP formerly the UW Tax-Sheltered Annuity TSA 403 b Program allows employees to invest a portion of their income for.

What S The Difference Between A Tax Sheltered Annuity And A 401 K

403 B Plan Guide To Tax Sheltered Annuity Plan For Retirement Focus On The User

457 Tsa Plans For Educators National Educational Services

Retirement Savings Tsas Tax Sheltered Annuity Plans North Marion School District Or

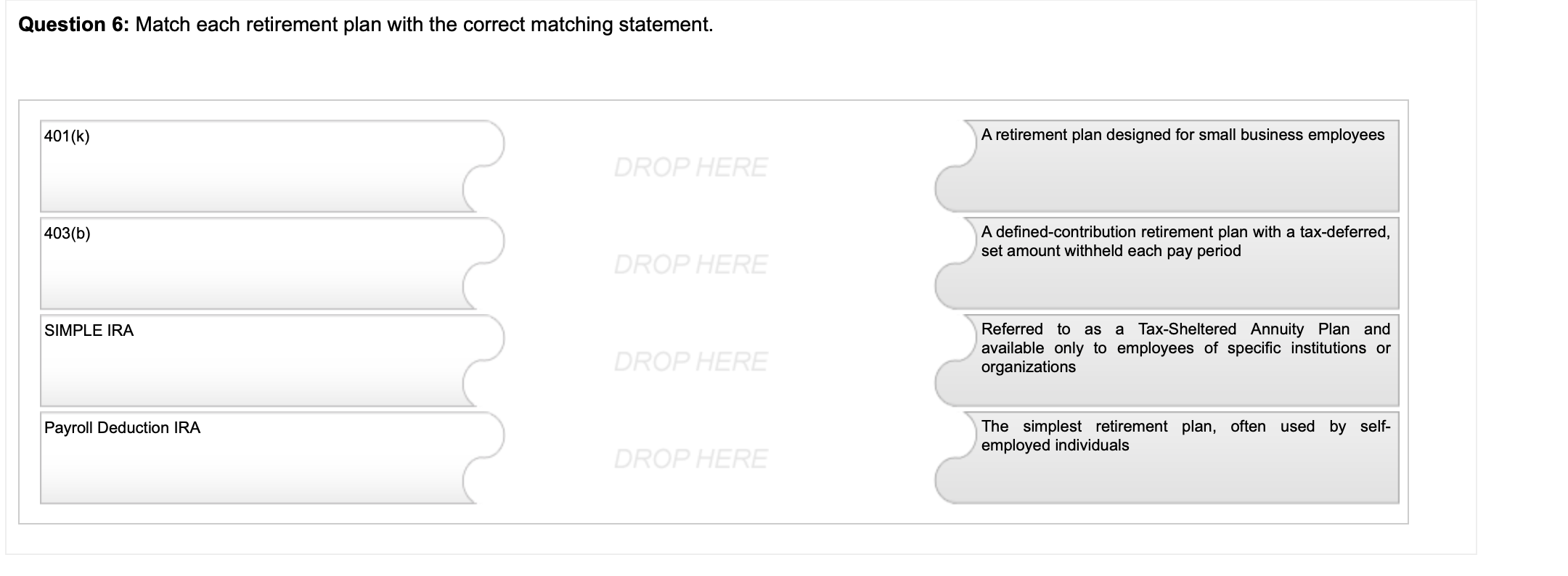

Solved Question 6 Match Each Retirement Plan With The Chegg Com

Business And Finance 403 B Tax Sheltered Annuity Documents

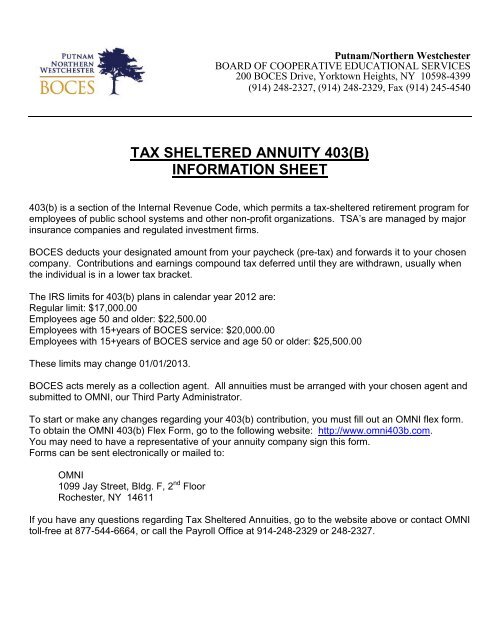

Tax Sheltered Annuity 403 B Information Sheet Boces

403 B Tsa Dcp Roth Edina Schools Payroll And Myview

Colusa Usd Tax Sheltered Annuities Tsa

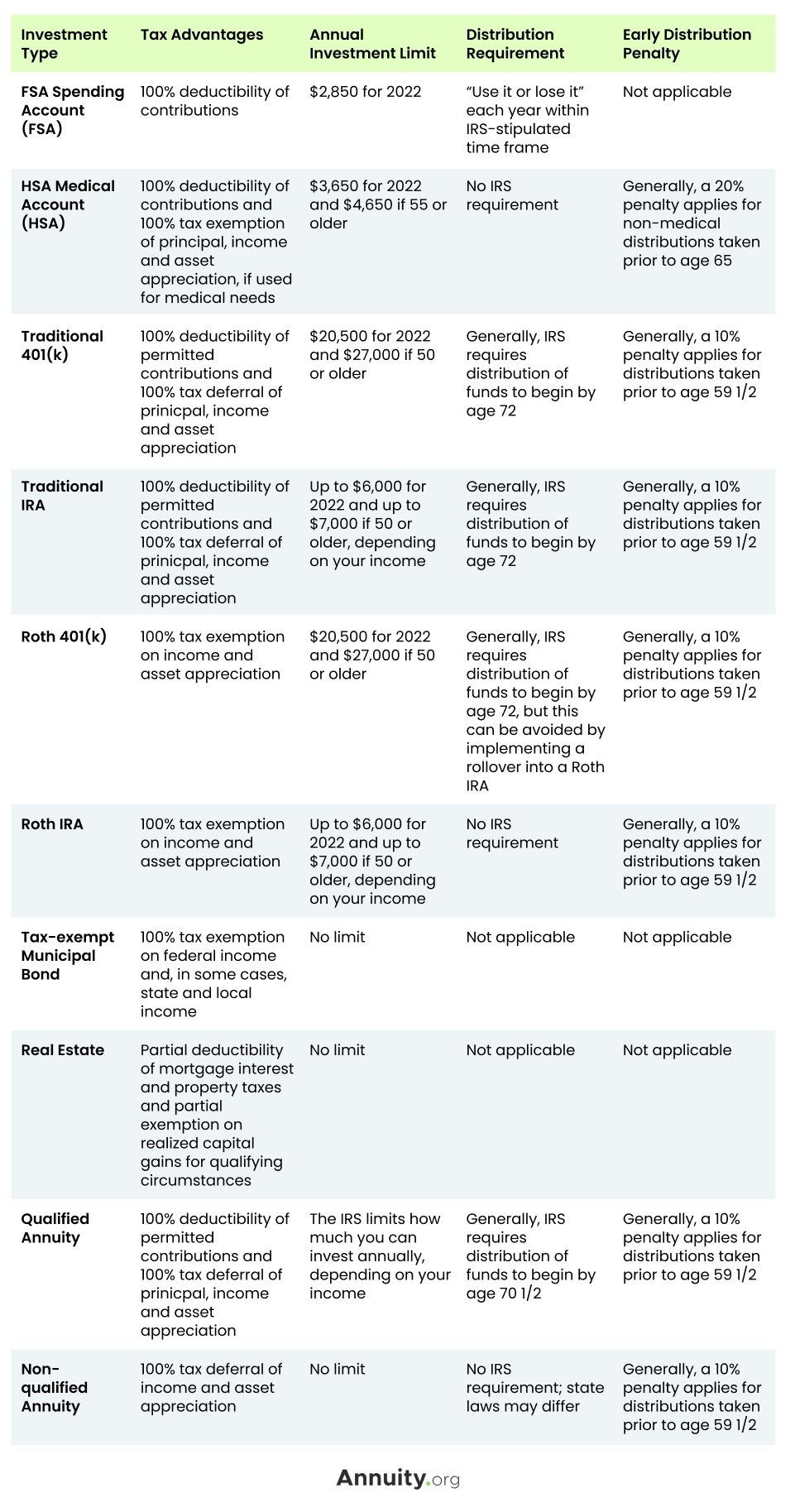

What Are Tax Sheltered Investments Types Risks Benefits

Tax Sheltered Annuity Faqs Employee Benefits

Tsa Tax Sheltered Annuities Teacher Savings Retirement Plans

Tax Sheltered Annuity Definition How Tsa 403 B Plan Works

Tax Sheltered Annuity 403b Plan Booklet Diocese Of Charlotte

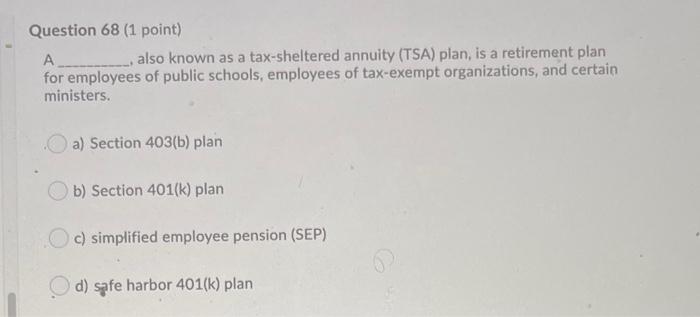

Solved Question 68 1 Point A Also Known As A Chegg Com

What Kinds Of Tax Favored Retirement Arrangements Are There Tax Policy Center

:max_bytes(150000):strip_icc()/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)